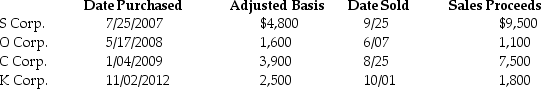

Mike sold the following shares of stock in 2013:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Definitions:

Paradox Of Voting

A situation in rational-choice theory where individual votes have little impact on the outcome, yet people still participate in elections.

Median-Voter Model

A political theory suggesting that the outcome of majority rule voting systems will represent the preferences of the median voter.

Public Good

A good that is non-excludable and non-rivalrous, meaning it can be enjoyed by all members of society without reducing its availability to others.

Majority Vote

A decision rule that selects alternatives which have a majority, that is, more than half the votes.

Q32: Erin,Sarah,and Timmy are equal partners in EST

Q34: A married person who files a separate

Q45: The total worthlessness of a security results

Q45: During 2013,Christiana's employer withheld $1,500 from her

Q57: Any distribution from a Qualified Tuition Plan

Q64: An individual may not qualify for the

Q71: What is required for an individual to

Q74: On its tax return,a corporation will use

Q107: On August 1 of the current year,Terry

Q108: Topaz Corporation had the following income and