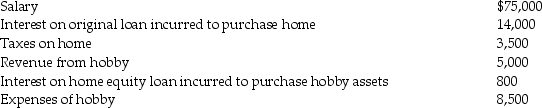

During the current year,Paul,a single taxpayer,reported the following items:

Compute Paul's taxable income for the year.

Compute Paul's taxable income for the year.

Definitions:

Assignment Method

A mathematical technique used for optimal allocation of jobs to resources, minimizing cost or maximizing efficiency in operations.

Project Hours

The total amount of time allocated or spent on the completion of tasks within a project, often tracked for management, billing, or productivity purposes.

Optimal Assignment

The most efficient allocation of resources, tasks, or individuals to various roles or positions, with the goal of maximizing productivity or minimizing costs.

Top Consultants

Highly regarded professionals in consulting who provide expert advice in their specific areas of expertise.

Q15: The Cable TV Company,an accrual basis taxpayer,allows

Q29: Amounts paid in connection with the acquisition

Q42: David,age 62,retires and receives $1,000 per month

Q51: Which of the following individuals is not

Q67: A closely-held C Corporation's passive losses may

Q70: Tom and Shawn own all of the

Q75: Miranda is not a key employee of

Q75: A capital loss may arise from the

Q91: Travel expenses for a taxpayer's spouse are

Q111: For federal income tax purposes,income is allocated