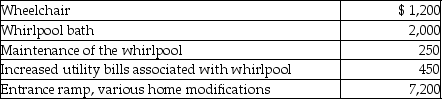

Alan,who is a security officer,is shot while on the job.As a result,Alan suffers from a chronic leg injury and must use a wheelchair and undergo therapy to regain and retain strength.Alan's physician recommends that he install a whirlpool bath in his home for therapy.During the year,Alan makes the following expenditures:  A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000.Alan's deductible medical expenses (before considering limitations based on AGI) will be

A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000.Alan's deductible medical expenses (before considering limitations based on AGI) will be

Definitions:

Net Revenue

The amount of money a company receives from its activities after subtracting the cost of returns, allowances, and discounts.

Total Profit

The total amount of money a company earns after subtracting the costs associated with producing and selling its products or services.

Early Finish Time

The earliest possible point in time when a particular task, project, or activity can be completed.

Q11: Ross works for Houston Corporation,which has a

Q12: Laura,the controlling shareholder and an employee of

Q19: Generally,an income tax return covers an accounting

Q24: Dighi,an artist,uses a room in his home

Q29: If an individual is self-employed,business-related expenses are

Q47: Derrick was in an automobile accident while

Q54: Mara owns an activity with suspended passive

Q111: If a loan has been made to

Q120: During the current year,Lucy,who has a sole

Q127: On July 25,2012,Karen gives stock with a