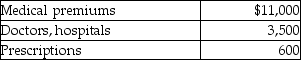

Caleb's medical expenses before reimbursement for the year include the following:  Caleb's AGI for the year is $50,000.He is single and age 58.Caleb also receives a reimbursement for medical expenses of $1,000.Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Caleb's AGI for the year is $50,000.He is single and age 58.Caleb also receives a reimbursement for medical expenses of $1,000.Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Definitions:

Individual Mandate

A requirement that individuals must have health insurance coverage or face penalties, as outlined in the Affordable Care Act.

Federal Subsidies

Federal subsidies are financial support and assistance provided by the federal government to organizations, businesses, and individuals in various sectors, including agriculture, health care, and energy, to support public policy objectives.

Interstate Commerce Clause

A provision in the U.S. Constitution granting Congress the power to regulate commerce among the states.

Individual Mandate

A requirement, initially part of the Affordable Care Act, that required individuals to have health insurance or face a penalty, intended to ensure that everyone is covered by health insurance.

Q11: In the current year,Andrew received a gift

Q41: In a like-kind exchange,both the property transferred

Q55: Personal property used in a rental activity

Q66: Once the business use of listed property

Q69: Which of the following statements regarding Health

Q79: On July 25 of this year,Raj sold

Q85: Richard traveled from New Orleans to New

Q96: This summer,Rick's home (which has a basis

Q99: Teri pays the following interest expenses during

Q110: How is a claim for refund of