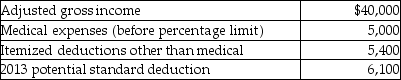

A review of the 2013 tax file of Gregory,a single taxpayer who is age 40,provides the following information regarding Gregory's 2013 tax status:  In 2014,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

In 2014,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

Definitions:

Presentation File

A digital file containing a series of slides or visuals designed for display during a presentation.

Italicize Text

The styling of text in a slanted font to emphasize a point, denote titles, or distinguish terms from the rest of the text in written materials.

Insertion Point

The cursor's position in a document or text field, indicating where new text will be entered.

Placeholder

A temporary marker in software, indicating where information will be later inserted or where existing data can be replaced.

Q8: A taxpayer guarantees another person's obligation and

Q14: Alvin,a practicing attorney who also owns an

Q24: Harley,a single individual,provided you with the following

Q38: Corporations issuing incentive stock options receive a

Q43: If an NOL is incurred,when would a

Q50: Abby owns a condominium in the Great

Q69: Marissa sold stock of a non-publicly traded

Q90: Mark and his brother,Rick,each own farms.Rick is

Q100: Generally,if inventories are an income-producing factor to

Q102: If stock sold or exchanged is not