MrAnd MrsThibodeaux,who Are Filing a Joint Return,have Adjusted Gross Income of of $75,000.During

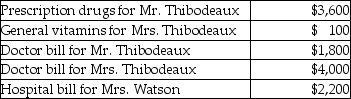

Mr.and Mrs.Thibodeaux,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Mean

The central value of a dataset, calculated as the sum of all values divided by the total number of values.

Standard Error

Standard error measures the accuracy with which a sample represents a population, quantifying the variability of the sampling distribution of a statistic.

Confidence Interval

A variety of values taken from sample data, expected to encompass the value of a not yet known population attribute.

Standard Error

A common measure of variability within a sample's distribution, particularly focused on the mean.

Q16: Elaine owns an unincorporated manufacturing business.In 2013,she

Q17: A deduction will be allowed for an

Q25: Corporate taxpayers may offset capital losses only

Q26: Feng,a single 40 year old lawyer,is covered

Q48: In a community property state,jointly owned property

Q53: Generally,expenses incurred in an investment activity other

Q73: For the years 2009 through 2013 (inclusive)Mary,a

Q79: All of the following are deductible as

Q107: On August 1 of the current year,Terry

Q119: In March of the current year,Marcus began