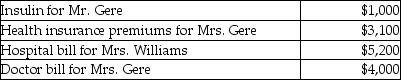

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Q2: Kathleen received land as a gift from

Q8: Ellie,a CPA,incurred the following deductible education expenses

Q18: Jordan,an employee,drove his auto 20,000 miles this

Q26: On May 1,2011,Empire Properties Corp.,a calendar year

Q29: A taxpayer is allowed to deduct interest

Q40: Eric is a self-employed consultant.In May of

Q41: Which of the following is true about

Q81: Losses are generally deductible if incurred in

Q88: Unless the alternate valuation date is elected,the

Q90: Discuss the timing of the allowable medical