Phoebe's AGI for the current year is $120,000.Included in this AGI is $100,000 salary and $20,000 of interest income.In earning the investment income,Phoebe paid investment interest expense of $30,000.She also incurred the following expenditures subject to the 2% of AGI limitation:

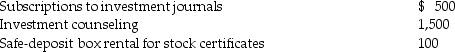

Investment expenses:

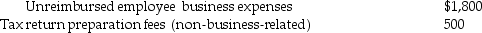

Noninvestment expenses:

Noninvestment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Definitions:

Testosterone

A steroid hormone produced mainly in the testes in males and the ovaries in females, playing a key role in the development of male reproductive tissues and secondary sexual characteristics.

Amygdala

A part of the brain within the temporal lobe that is involved in emotions, decision-making, and memory processing, notably in fear and pleasure responses.

Components of Happiness

The various elements that contribute to an individual’s sense of well-being and satisfaction with life, such as emotional, psychological, and social well-being.

Acknowledged

Recognized as being true or existing, especially in a formal or official way.

Q1: Expenses incurred in a trade or business

Q2: The exchange of a partnership interest for

Q29: A taxpayer is allowed to deduct interest

Q42: Over the years Rianna paid $65,000 in

Q42: Taxpayers may use the standard mileage rate

Q55: C corporations and partnerships with a corporate

Q81: If a company acquires goodwill in connection

Q82: The mid-quarter convention applies to personal and

Q94: In a contributory defined contribution pension plan,all

Q96: Bret carries a $200,000 insurance policy on