MrAnd MrsThibodeaux,who Are Filing a Joint Return,have Adjusted Gross Income of of $75,000.During

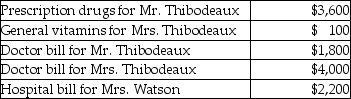

Mr.and Mrs.Thibodeaux,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Vital Life Functions

The essential bodily processes necessary for maintaining life, including respiration, circulation, and digestion.

Irreversible Cessation

A permanent halt in function or activity, often used in the context of the cessation of biological life functions or processes.

Stage Theory

A theory of development characterized by distinct periods of life.

Inpatient

A patient who stays in a hospital while under treatment, as opposed to outpatient who visits the hospital for treatment without staying overnight.

Q18: Ted pays $2,100 interest on his automobile

Q41: A charitable contribution in excess of the

Q45: In order for an asset to be

Q45: Armanti received a football championship ring in

Q72: Dana purchased an asset from her brother

Q80: Martha,an accrual-method taxpayer,has an accounting practice.In 2012,she

Q81: Linda was injured in an automobile accident

Q82: Juan has a casualty loss of $32,500

Q94: On January 31 of this year,Jennifer pays

Q108: Topaz Corporation had the following income and