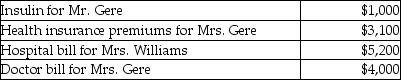

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Economic Growth

The increase in the production of goods and services in an economy over a period of time, typically measured as the annual rate of increase in real GDP.

Portfolio Return

The overall gain or loss experienced by an investment portfolio over a specified period.

Stock Returns

The gain or loss made on an investment in shares, generally represented as a percentage of the investment’s initial cost.

Business Cycle

The fluctuation of economic activity that an economy experiences over a period of time, marked by phases of expansion and contraction.

Q2: Kathleen received land as a gift from

Q2: Benedict serves in the U.S.Congress.In the current

Q46: Olivia,a single taxpayer,has AGI of $280,000 which

Q55: C corporations and partnerships with a corporate

Q57: DeMarcus and Brianna are married and live

Q67: The look-back interest adjustment involves the<br>A)calculation of

Q81: If a company acquires goodwill in connection

Q91: Fines and penalties are tax deductible if

Q96: This summer,Rick's home (which has a basis

Q118: Brett,an employee,makes the following gifts,none of which