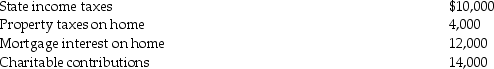

Tasneem,a single taxpayer has paid the following amounts this year:  Tasneem's AGI is $360,000.What is her net itemized deduction allowed?

Tasneem's AGI is $360,000.What is her net itemized deduction allowed?

Definitions:

Market

A place or system where buyers and sellers interact to trade goods, services, or securities.

Inventory Item

A product or goods held by a company for the purpose of sale or production in the normal course of business.

Inventory Turnover

Inventory turnover is a ratio that measures how many times a company's inventory is sold and replaced over a specific period, indicating efficiency in inventory management.

Average Daily Cost

The total cost associated with a process or product divided by the number of days in the period being considered.

Q1: Which of the following partnerships can elect

Q24: At the election of the taxpayer,a current

Q31: A taxpayer must use the same accounting

Q49: Distinguish between the Corn Products doctrine and

Q56: Unless an election is made to expense

Q78: Under MACRS,tangible personal property used in trade

Q90: A theft loss is deducted in the

Q95: Jordan paid $30,000 for equipment two years

Q110: Tessa is a self-employed CPA whose 2013

Q116: Jan purchased an antique desk at auction.For