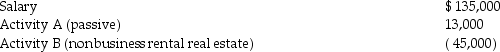

Parveen is married and files a joint return.He reports the following items of income and loss for the year:

If Parveen actively participates in the management of Activity B,what is his AGI for the year and what is the passive loss carryover to next year?

If Parveen actively participates in the management of Activity B,what is his AGI for the year and what is the passive loss carryover to next year?

Definitions:

Lifestyle Segmentation

Segmentation that divides people into groups based on their opinions and the interests and activities they pursue.

Psychographic Segmentation

A marketing technique that divides consumers into sub-groups based on shared psychological characteristics, values, desires, or lifestyles.

Metropolitan Statistical Areas

Geographic regions defined by high population density at their core and close economic ties throughout the area, often used for statistical purposes.

Psychographic Segmentation

The division of a market into segments based on consumer psychology, including their lifestyles, values, attitudes, and personality traits.

Q8: Gains and losses from involuntary conversions of

Q22: Erin,a single taxpayer,has 1,000 shares of 1244

Q35: Which of the following statements regarding independent

Q36: An uncle gifts a parcel of land

Q60: Stephanie's building,which was used in her business,was

Q73: Explain when educational expenses are deductible for

Q74: The maximum tax deductible contribution to a

Q82: The mid-quarter convention applies to personal and

Q104: Discuss tax planning considerations which a taxpayer

Q115: An expense is considered necessary if it