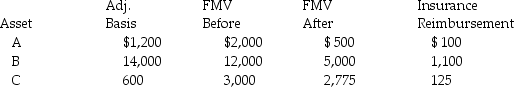

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2013 and the following occurred:

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Periodic Inventory System

A method of inventory valuation where updates to inventory levels and cost of goods sold are made periodically at the end of an accounting period, rather than after each sale or purchase.

LIFO Method

An inventory valuation method that assumes the last items placed in inventory are the first sold during an accounting year.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including materials, labor, and overhead.

Weighted-Average

A calculation that takes into account the varying degrees of importance of the numbers in a data set, giving more weight to some numbers than others.

Q21: For a bad debt to be deductible,the

Q48: This year,Jason sold some qualified small business

Q50: Tina,whose marginal tax rate is 33%,has the

Q61: Sec.1245 applies to gains on the sale

Q61: The MACRS system requires that residential real

Q69: Which of the following is not required

Q80: Explain the rules for determining whether a

Q92: Debbie's Donuts is planning a major expansion

Q96: According to the tax formula,individuals can deduct

Q100: Luke's offshore drilling rig with a $700,000