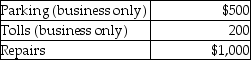

Brittany,who is an employee,drove her automobile a total of 20,000 business miles in 2013.This represents about 75% of the auto's use.She has receipts as follows:  Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Definitions:

Data Points

Individual observations or measurements recorded during a study or experiment.

SSE

Sum of Squared Errors, a measure used in statistics to quantify the discrepancy between the observed and predicted values.

Null Hypothesis

A default statement that there is no difference or effect, used as a starting point for statistical hypothesis testing.

Independent Variables

Variables in an experiment or model that are manipulated or categorized to determine their effect on dependent variables.

Q5: Prior Corp.plans to change its method of

Q8: A taxpayer guarantees another person's obligation and

Q13: Ruby Corporation grants stock options to Iris

Q26: A business which provides a warranty on

Q36: Joan bought a business machine for $15,000

Q47: Expenditures for long-term care insurance premiums qualify

Q88: Lewis died during the current year.Lewis owned

Q95: Daniella exchanges business equipment with a $100,000

Q97: Under UNICAP,all of the following overhead costs

Q120: Travel expenses related to foreign conventions are