Multiple Choice

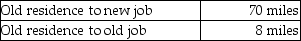

Donald takes a new job and moves to a new residence.The distances are as follows:  By how many miles does the move exceed the minimum distance requirement for the moving expense deduction?

By how many miles does the move exceed the minimum distance requirement for the moving expense deduction?

Grasp the essentials of macroeconomics in the context of healthcare.

Identify and assess the variability in Medicaid eligibility requirements across states.

Distinguish key economic indicators and their relevance to healthcare economics.

Recognize the role of third-party payers in the healthcare system.

Definitions:

Related Questions

Q5: In 2006,Regina purchased a home in Las

Q5: In accounting for research and experimental expenditures,all

Q24: In order for the gain on the

Q35: When depreciating 5-year property,the final year of

Q43: Dustin purchased 50 shares of Short Corporation

Q45: Tyne is a 48-year-old an unmarried taxpayer

Q71: In an involuntary conversion,the basis of replacement

Q97: Under UNICAP,all of the following overhead costs

Q103: Which of the following statements is false?<br>A)A

Q109: Candice owns a mutual fund that reinvests