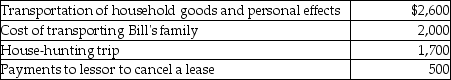

Bill obtained a new job in Boston.He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Definitions:

Postage-Paid Reply Card

A pre-addressed and prepaid card included with mailings that recipients can use to respond or request information without incurring postage costs.

Personal Selling

A direct marketing approach where salespeople interact face-to-face with potential customers to present products or services.

Promotion Alternatives

Various strategies or methods used by businesses to advertise, market, and sell their products or services.

Direct Marketing

Direct marketing refers to a strategy where businesses communicate directly with targeted customers through various channels, including mail, email, and telephone, to generate a response or transaction.

Q6: A partnership must generally use the same

Q7: The earned income credit is refundable only

Q14: West's adjusted gross income was $90,000.During the

Q28: If a taxpayer makes a charitable contribution

Q28: All of the following are true of

Q48: Cheryl owns 200 shares of Cornerstone Corporation

Q80: Medical expenses in excess of 10% of

Q98: The foreign tax credit is equal to

Q100: If a meeting takes place at a

Q105: Mick owns a racehorse with a $500,000