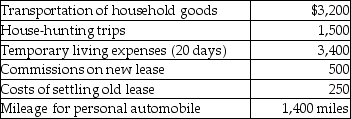

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Definitions:

Selling and Administrative Expense Budget

An estimation of the costs related to sales and administrative activities for a specific period, used for planning and control.

Direct Materials

Raw materials that can be directly associated with the production of specific goods or services.

Direct Labor

The wages and benefits paid for labor that is directly involved in the production of goods or the provision of services.

Variable Selling

This term likely refers to variable selling expenses, which are costs that fluctuate with sales volume, such as commissions or shipping fees.

Q35: Dean exchanges business equipment with a $120,000

Q37: Martin Corporation granted an incentive stock option

Q39: Bobbie exchanges business equipment (adjusted basis $160,000)for

Q54: Points paid on a mortgage to buy

Q55: During the year,Patricia realized $10,000 of taxable

Q58: If a new luxury automobile is used

Q81: Sec.1245 can increase the amount of gain

Q94: Emeril borrows $340,000 to finance taxable and

Q96: Trista,a taxpayer in the 33% marginal tax

Q99: What are arguments for and against preferential