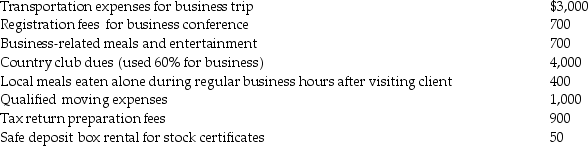

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Responsibility

The obligation to complete tasks, make decisions, and be accountable for outcomes.

Hackman And Oldham

Refers to the Job Characteristics Model proposed by J. Richard Hackman and Greg Oldham, which outlines how job design contributes to employee motivation, satisfaction, and performance.

Task Identity

The degree to which a job requires completion of a whole and identifiable piece of work.

Autonomy

The capacity to make an informed, uncoerced decision or the independence in personal or professional life.

Q17: On September 1,of the current year,James,a cash-basis

Q18: If property that qualifies as a taxpayer's

Q23: During 2013 and 2014,Danny pays property taxes

Q50: In July of 2013,Pat acquired a new

Q61: Individual taxpayers can offset portfolio income with

Q63: Amelia exchanges an office building with a

Q73: For the years 2009 through 2013 (inclusive)Mary,a

Q79: Greta,a calendar-year taxpayer,acquires 5-year tangible personal property

Q84: Gertie has a NSTCL of $9,000 and

Q106: An individual taxpayer has negative taxable income