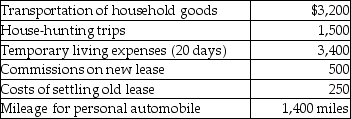

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Definitions:

Behavioral Approach

A method in leadership studies focusing on observable behaviors of leaders and how these behaviors affect their effectiveness.

Leadership Behaviors

Actions and practices exhibited by leaders that influence their followers' performance, motivation, and satisfaction.

High-High Style

A leadership approach emphasizing high levels of both task orientation and relationship orientation in managing teams or organizations.

Performance Outcomes

The results or achievements derived from the efforts and actions of an individual or team in a given task or objective.

Q2: Explain how tax planning may allow a

Q3: During the current year,Donna,a single taxpayer,reports the

Q19: For individuals,all deductible expenses must be classified

Q25: The Section 179 expensing election is available

Q40: For purposes of the application of the

Q47: Ike and Tina married and moved into

Q53: Why did Congress establish favorable treatment for

Q88: A credit for rehabilitation expenditures is available

Q96: In order for a taxpayer to deduct

Q98: Patrick and Belinda have a twelve year