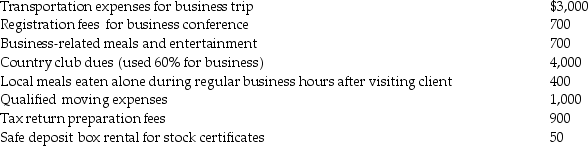

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Market Structures

The organizational and other characteristics of a market, including the level of competition, product differentiation, and the ease of entry and exit, which determine the nature of pricing and output decisions.

Purely Competitive Firm

A company operating in a market with many sellers offering identical products, where no single seller can influence the market price.

Downward-sloping

A description of a line or curve on a graph that represents a decrease in one variable in response to an increase in another variable, commonly used to describe demand curves in economics.

Demand Curve

A visual chart demonstrating the link between an item's price and the amount consumers are willing to buy at those prices.

Q26: Feng,a single 40 year old lawyer,is covered

Q35: When depreciating 5-year property,the final year of

Q35: Dean exchanges business equipment with a $120,000

Q36: Deferred compensation refers to methods of compensating

Q71: In-home office expenses which are not deductible

Q75: Expenditures incurred in removing structural barriers in

Q81: Grace has AGI of $60,000 in 2012

Q95: Wayne and Maria purchase a home on

Q106: An individual taxpayer has negative taxable income

Q110: All of the following are allowable deductions