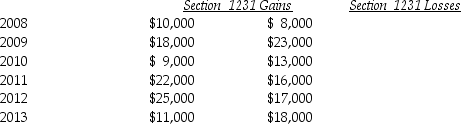

Lucy,a noncorporate taxpayer,experienced the following Section 1231 gains and losses during the years 2008 through 2013.Her first disposition of a Sec.1231 asset occurred in 2008.Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Definitions:

Overly Positive Outcome Expectancies

An individual's unrealistic anticipation or belief that favorable results will occur, often without considering potential negative outcomes.

Immediate Determinants

Refers to factors that directly affect a situation or outcome, often in the context of health or social issues.

Lack of Coping Skills

The absence or inadequacy of mechanisms or strategies to effectively manage stress, difficulties, or emotional challenges.

Stress Among Clients

The experience of psychological strain or tension in clients, which may impact their health or engagement with services.

Q2: Sam retired last year and will receive

Q47: Except in a few specific circumstances,once adopted,an

Q51: Characteristics of profit-sharing plans include all of

Q53: Chocolat Inc.is a U.S.chocolate manufacturer.Its domestic production

Q82: Appeals from the Court of Appeals go

Q88: Jared wants his daughter,Jacqueline,to learn about the

Q97: Joe has $130,000 net earnings from a

Q99: WAM Corporation sold a warehouse during the

Q116: Blue Corporation distributes land and building having

Q117: Voluntary revocation of an S corporation election