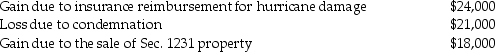

The following gains and losses pertain to Jimmy's business assets that qualify as Sec.1231 property.Jimmy does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Restricted Fund

Funds that are earmarked for a particular purpose or project by donors or grantors and cannot be freely used for any other expenditures.

Investment Income

Income earned from investments, including dividends, interest, and capital gains from securities, real estate, or other assets.

Deferral Method

An accounting practice where certain revenues or expenses are deferred to a future accounting period to better match revenues with expenses.

Deferred Contribution

Refers to contributions or payments that are postponed to a future date rather than being made immediately.

Q4: Any Section 179 deduction that is not

Q22: Realized gain or loss must be recognized

Q51: Nonrefundable tax credits<br>A)only offset a taxpayer's tax

Q72: Felicia contributes property with a FMV of

Q74: On its tax return,a corporation will use

Q77: Partnerships,S corporations,and personal service corporations may elect

Q93: Nonqualified deferred compensation plans can discriminate in

Q103: Identify which of the following statements is

Q104: What factors are considered in determining whether

Q126: Sycamore Corporation's financial statements show the following