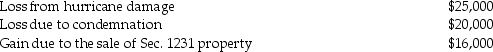

The following gains and losses pertain to Arnold's business assets that qualify as Sec.1231 property.Arnold does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Critical Industrial Relations

An analytical approach focusing on the power dynamics and conflicts between employers, employees, and unions in the workplace.

Capitalism

An economic system based on private ownership of the means of production and the creation of goods or services for profit, characterized by competitive markets and capital accumulation.

Wealth And Capital

Terms related to the accumulation of valuable resources and assets, with "wealth" often referring to the stock of assets held, and "capital" usually meaning funds or resources used for investment and production.

Powerful Governments

Governments that have substantial control and influence over both domestic and international affairs, often characterized by strong leadership and comprehensive policies.

Q19: Generally,an income tax return covers an accounting

Q30: Intangible drilling and development costs (IDCs)may be

Q33: In which of the following situations is

Q35: Danielle transfers land with a $100,000 FMV

Q54: Section 1231 property will generally have all

Q70: Ted purchases and places in service in

Q75: Identify which of the following statements is

Q78: Ross purchased a building in 1985,which he

Q83: Compare and contrast "interpretative" and "statutory" regulations.

Q84: Bonjour Corp.is a U.S.-based corporation with operations