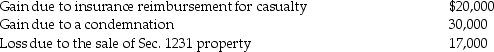

The following are gains and losses recognized in 2013 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

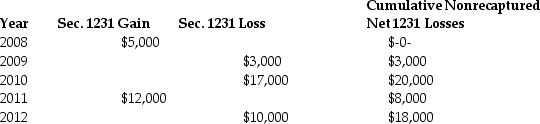

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Activity Rate

refers to the cost driver rate that is used in activity-based costing to allocate costs to products or services.

Indirect Labor

Labor costs associated with workers who assist in the production process but do not directly contribute to the manufacturing of the product.

Plantwide Factory

The application of a single overhead rate to allocate all manufacturing overhead costs uniformly throughout a production plant.

Direct Labor Hours

The total hours worked by employees directly involved in the production of goods or services.

Q2: Identify which of the following statements is

Q21: The citation "Rev.Rul.2006-8,2006-1 C.B.541" refers to<br>A)the eighth

Q32: When a court discusses issues not raised

Q41: Casualty and theft losses in excess of

Q45: A corporation has $100,000 of U.S.source taxable

Q52: In all situations,tax considerations are of primary

Q65: Costs of tangible personal business property which

Q71: Explain the legislative reenactment doctrine.

Q108: Amber receives a residence ($750,000 FMV,$500,000 adjusted

Q127: John transfers assets with a $200,000 FMV