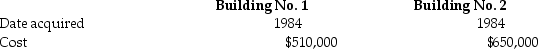

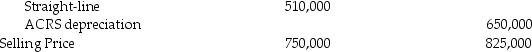

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for Building No.1 and the accelerated method (ACRS)was used for Building No.2.Information about those buildings is presented below.

Accum.Depreciation

Accum.Depreciation

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture?

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture?

Definitions:

Q12: If personal-use property is converted to trade

Q17: Discuss whether a C corporation,a partnership,or an

Q17: Indicate with a "yes" or a "no"

Q18: The corporate built-in gains tax does not

Q39: Under the MACRS system,the same convention that

Q51: All costs of organizing a partnership can

Q70: In 1980,Artima Corporation purchased an office building

Q95: The transfer of property to a partnership

Q100: If a meeting takes place at a

Q115: S status can be elected if 50%