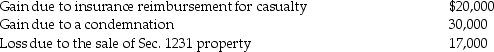

The following are gains and losses recognized in 2013 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

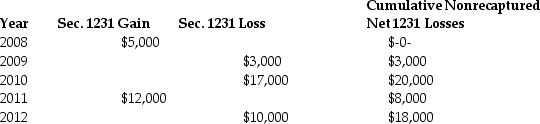

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Customer Satisfaction

A measure of how products or services provided by a company meet or surpass the customer's expectations.

Controlling in Organisations

The management function concerned with monitoring activities to ensure they are being completed as planned and correcting any significant deviations.

One-Time Activities

Tasks or events that are intended to be done or occur only once within a given timeframe.

Beginning and End Points

The start and completion points in a process, project, or timeline.

Q3: Generally,economic performance must occur before an expense

Q8: Bob owns a warehouse that is used

Q9: In year 1 a contractor agrees to

Q14: Taxpayers must pay the disputed tax prior

Q21: In a limited partnership,the limited partners are

Q36: Bergeron is a local manufacturer of off-shore

Q54: Savings accounts and money market funds are

Q75: Johanna is single and self-employed as a

Q83: All of the following are self-employment income

Q102: Nicki is single and 46 years old.She