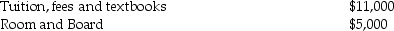

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2013:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Self-efficacy

An individual's belief in their capacity to execute behaviors necessary to produce specific performance attainments.

Employee Motivation

The amount of vigor, devotion, and innovation that a corporation's staff contributes to their work.

Performance Monitoring

A process where managers regularly review employees' work performance and outcomes to ensure consistency with organizational goals.

Task Accomplishment

The successful completion of a task or assignment within a specified time frame.

Q8: All of the following statements are true

Q9: Income of a C corporation is subject

Q12: In the Exempt Model,the earnings are exempt

Q41: Arnie is negotiating the sale of land

Q43: Gains on sales or exchanges between a

Q52: Jesse installed solar panels in front of

Q53: The cost of capital of each source

Q71: Vidya can invest $5,000 of after-tax dollars

Q74: The formula for the after-tax accumulation (ATA)for

Q75: In computing the alternative minimum taxable income,no