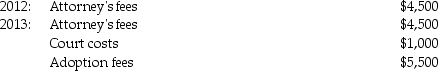

Tyler and Molly,who are married filing jointly with $200,000 of AGI in 2013,incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2013.What is the amount of the allowable adoption credit in 2013?

The adoption was finalized in 2013.What is the amount of the allowable adoption credit in 2013?

Definitions:

Oppressive Society

A social system characterized by unjust treatment and control, where power is exercised by one group over another in a harmful or restrictive manner.

Culturally Competent

Having the skills, knowledge, and attitudes that allow individuals or organizations to work effectively in cross-cultural situations.

Ethnocentricity

The belief in the inherent superiority of one's own ethnic group or culture, often accompanied by a generalized view of other cultures.

Jim Crow Laws

Laws enacted in the Southern United States after the Civil War to enforce racial segregation and undermine the rights of African Americans.

Q3: Which of the following courts is not

Q14: Alvin,a practicing attorney who also owns an

Q33: Lunar Corporation purchased and placed in service

Q56: Assume that the Tax Court decided an

Q63: Musketeer Corporation has the following income and

Q64: Patricia exchanges office equipment with an adjusted

Q74: The formula for the after-tax accumulation (ATA)for

Q83: All of the following are self-employment income

Q89: A owns a ranch in Wyoming,which B

Q107: Identify which of the following statements is