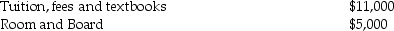

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2013:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Liabilities

Financial obligations or debts that a company or individual owes to others.

Expenses

Costs incurred in the process of generating revenue, including operating expenses, cost of goods sold, and other overheads.

Accounting

The systematic process of recording, analyzing, summarizing, and reporting the financial transactions of a business or individual.

Recordkeeping

The process of maintaining records or documents that track an organization's financial transactions and history.

Q4: The receipt of boot as part of

Q6: Discuss the rules regarding the holding period

Q13: The uniform capitalization rules (UNICAP)require the capitalization

Q16: Which of the following statements regarding involuntary

Q20: Yael exchanges an office building worth $150,000

Q36: If a corporation's charitable contributions exceed the

Q59: In the Deferred Model,<br>A)investment earnings are taxed

Q61: Stephanie owns a 25% interest in a

Q73: Jeremy has $18,000 of Section 1231 gains

Q110: What are special allocations of partnership items