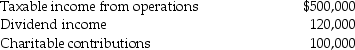

Concepts Corporation reported the following results for the current year:

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly-traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly-traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Definitions:

Gallons

A unit of volume for liquid measure in both the US customary units and the British imperial system, used to quantify fuel, milk, water, and other liquids.

Gasoline

A petroleum-derived liquid mixture used primarily as fuel in internal combustion engines.

Miles

A unit of distance equal to 5,280 feet or approximately 1.609 kilometers.

Square Yard

a unit of area measurement equivalent to a square measuring one yard on each side.

Q19: A flow-through entity's primary characteristic is that

Q21: An example of an AMT tax preference

Q42: The general business credit includes all of

Q48: Describe the tax treatment for a noncorporate

Q70: In computing AMTI,tax preference items are<br>A)excluded.<br>B)added only.<br>C)subtracted

Q81: A Technical Advice Memorandum is usually<br>A)an internal

Q82: Emma owns a small building ($120,000 basis

Q98: The building used in Manuel's business was

Q99: Small case procedures of the U.S.Tax Court

Q100: George transferred land having a $170,000 FMV