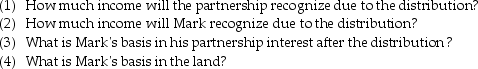

Mark receives a nonliquidating distribution of $10,000 cash and a parcel of land having an adjusted basis of $18,000 and a fair market value of $25,000.

a.Mark's basis in his partnership interest prior to the distribution is $50,000.

b.Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

b.Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

Definitions:

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a fixed asset since it was acquired and put into use.

Unearned Ticket Revenue

Revenue received from tickets sold for future events, which is considered a liability until the service (the event) is provided.

Adjusted Trial Balance

An accounting worksheet that reflects the account balances after adjustments are made for accruals and deferrals at the end of a reporting period.

Net Income

The total earnings of a company after subtracting all expenses, including taxes and operating costs, indicating the profitability over a specified time period.

Q3: The par value on a common stock

Q17: In the current year,Bosc Corporation has taxable

Q30: The Roth IRA is an example of

Q53: A firm issued 10,000 shares of no

Q56: In general,net operating losses of a corporation

Q63: The greater the range of an asset's

Q76: Shares of stock currently owned by a

Q84: Which of the following is a source

Q122: The expected value,standard deviation of returns,and coefficient

Q155: Given the information in Table 8.2,what is