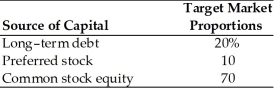

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year,$1,000 par value,7 percent bond for $960.A flotation cost of

Debt: The firm can sell a 12-year,$1,000 par value,7 percent bond for $960.A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value.The stock will pay a $10 annual dividend.The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share.The dividend expected to be paid at the end of the coming year is $1.74.Its dividend payments have been growing at a constant rate for the last four years.Four years ago,the dividend was $1.50.It is expected that to sell,a new common stock issue must be underpriced $1 per share in floatation costs.Additionally,the firm's marginal tax rate is 40 percent.

-If the target market proportion of long-term debt is reduced to 15 percent - increasing the proportion of common stock equity to 75 percent,what will be the revised weighted average cost of capital? (See Table 9.1)

Definitions:

Activity-based Budgeting

A budgeting approach where budgets are based on the activities and resources necessary to achieve an organization's goals.

Capital Expenditures Budget

A plan for projected expenditures on physical assets that will be used for more than one year, aimed at maintaining or improving the company's operations.

Continuous Budgeting

A process of constantly updating a budget for a set period in the future to reflect changes as they happen.

Safety Stock

Additional inventory held by a company to prevent stockouts, usually due to uncertainties in supply and demand.

Q1: Discuss the concept of partnership guaranteed payments.

Q33: Flow-through entities include all of the following

Q52: Why are some partnership items separately stated?

Q56: Assume that the Tax Court decided an

Q65: Discuss the conflict between advocacy for a

Q67: The AAA Partnership makes an election to

Q76: When capital or Sec.1231 assets are transferred

Q83: Compare and contrast "interpretative" and "statutory" regulations.

Q99: Debt is generally the least expensive source

Q112: Oliver receives a nonliquidating distribution of land