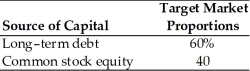

Table 9.2

A firm has determined its optimal structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 15-year,$1,000 par value,8 percent bond for $1,050.A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Debt: The firm can sell a 15-year,$1,000 par value,8 percent bond for $1,050.A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Common Stock: A firm's common stock is currently selling for $75 per share.The dividend expected to be paid at the end of the coming year is $5.Its dividend payments have been growing at a constant rate for the last five years.Five years ago,the dividend was $3.10.It is expected that to sell,a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs.Additionally,the firm has a marginal tax rate of 40 percent.

-The firm's cost of a new issue of common stock is ________.(See Table 9.2)

Definitions:

Interdependent Relationships

Connections between entities or individuals wherein they depend on each other to some extent, highlighting the mutual dependence aspect.

Mutual Gains

A situation where all parties involved in a negotiation or agreement benefit from the outcome.

Win-Win

A negotiation or dispute resolution outcome in which all parties achieve their objectives or receive mutual benefits.

Complex Conflict

A dispute that involves multiple issues, parties, or both and is characterized by high levels of uncertainty and interdependence.

Q47: Individuals Julie and Brandon form JB Corporation.Julie

Q47: The weighted average cost of capital (WACC)reflects

Q47: Interest rate risk is the chance that

Q54: The corporate capital loss carryback and carryover

Q71: According to the CAPM,the required return of

Q77: Perry purchased 100 shares of Ferro,Inc.common stock

Q84: Although a partner's distributive share of income,deductions,losses,and

Q111: A firm has experienced a constant annual

Q116: Any action taken by a financial manager

Q187: Nico invested an amount a year ago