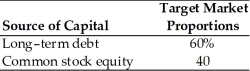

Table 9.2

A firm has determined its optimal structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 15-year,$1,000 par value,8 percent bond for $1,050.A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Debt: The firm can sell a 15-year,$1,000 par value,8 percent bond for $1,050.A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Common Stock: A firm's common stock is currently selling for $75 per share.The dividend expected to be paid at the end of the coming year is $5.Its dividend payments have been growing at a constant rate for the last five years.Five years ago,the dividend was $3.10.It is expected that to sell,a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs.Additionally,the firm has a marginal tax rate of 40 percent.

-Assuming the firm plans to pay out all of its earnings as dividends,the weighted average cost of capital is ________.(See Table 9.2)

Definitions:

Developmental Stages

Represent phases in human growth and development characterized by distinct physical, cognitive, and emotional changes that occur in a predictable sequence.

Social Forces

The societal structures, cultural norms, and institutions that influence individual behaviors, actions, and interactions.

Biological Forces

Natural and inherent influences on human behavior and development, including genetics and physiological processes.

Development

The process of growth or progress, often referring to physical, psychological, or social evolution over time.

Q20: Unlike creditors,equityholders are owners of the firm.

Q40: Assuming a risk-free rate of 8 percent

Q52: A corporation is owned 70% by Jones

Q72: The weights used in weighted average cost

Q85: China Imports currently has 2,000 shares of

Q88: Compute the value of a share of

Q114: A preferred stockholder is sometimes referred to

Q121: A tax adjustment must be made in

Q134: The market price of a callable bond

Q145: Combining two less than perfectly positively correlated