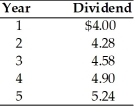

A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year.A new issue of stock is expected to be sold for $98,with $2 per share representing the underpricing necessary in the competitive capital market.Flotation costs are expected to total $1 per share.The dividends paid on the outstanding stock over the past five years are as follows:  The cost of this new issue of common stock is ________.

The cost of this new issue of common stock is ________.

Definitions:

Objective Lens

The lens in a microscope closest to the specimen, crucial for magnifying the image.

Paper Towel

A disposable absorbent towel made from paper, used for drying hands, wiping surfaces, or cleaning up spills.

Focal Plane

A specific plane through which light rays are sharply focused after passing through a lens or optical system.

Magnification

The process of making an object appear larger than its actual size, typically using lenses or microscopes.

Q11: What are the characteristics of the Pension

Q41: If a partner contributes depreciable property to

Q63: Musketeer Corporation has the following income and

Q69: Ordinary income may result if a partnership

Q78: A corporation that uses both debt and

Q85: The acquiescence policy of the IRS extends

Q112: A firm finances its activities with both

Q118: Using the Capital Asset Pricing Model (CAPM),the

Q120: Lance transferred land having a $180,000 FMV

Q193: In most cases,the longer the maturity of