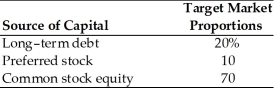

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's before-tax cost of debt is ________. (See Table 9.1)

Definitions:

Laminar Blood Flow

Laminar blood flow describes the smooth, orderly movement of blood through vessels, where layers of blood move parallel to the vessel wall without mixing.

Innermost Layer

The deepest or most central layer within a structure.

Outermost Layer

The external surface or layer of an object or organism, often serving as a protective barrier.

Internal Jugular Veins

Large veins located in the neck that carry blood from the head back to the heart.

Q17: In valuation of common stock,the price/earnings multiple

Q34: A corporation may make an election to

Q56: Which of the following assets may cause

Q72: Discuss the decision rules for current salary

Q81: A controlled group of corporations must apportion

Q86: Corey Corporation reported the following results for

Q105: On January 1 of this year (assume

Q105: In U.S.,during the past 90 years,on average

Q120: Tara transfers land with a $690,000 adjusted

Q146: At year end,Tangshan China Company balance sheet