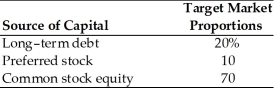

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's after-tax cost of debt is ________. (See Table 9.1)

Definitions:

Freedom of Choice

The right of individuals to make decisions for themselves without undue government restriction.

Society's Wants

The collective desires and needs of a community or society that drive demand and economic activity.

Exchange and Trade

The act of giving one thing and receiving another between two parties, typically involving goods, services, or both.

Capitalist Economy

An economic system where private individuals rather than the state own and control businesses and the means of production.

Q7: Patrick acquired a 50% interest in a

Q11: If the expected return is less than

Q15: All of the following could file partnership

Q18: Current interest rates on bonds of different

Q74: A firm has issued preferred stock at

Q97: In calculating the cost of common stock

Q112: In an efficient market,the expected return and

Q113: Suppose the CAPM is true.Asset X has

Q124: The Bradshaw Company's most recent dividend was

Q135: To compensate for the uncertainty of future