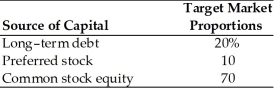

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year,$1,000 par value,7 percent bond for $960.A flotation cost of

Debt: The firm can sell a 12-year,$1,000 par value,7 percent bond for $960.A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value.The stock will pay a $10 annual dividend.The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share.The dividend expected to be paid at the end of the coming year is $1.74.Its dividend payments have been growing at a constant rate for the last four years.Four years ago,the dividend was $1.50.It is expected that to sell,a new common stock issue must be underpriced $1 per share in floatation costs.Additionally,the firm's marginal tax rate is 40 percent.

-The firm's cost of retained earnings is ________.(See Table 9.1)

Definitions:

Hyperactive

Hyperactive describes a condition of having more energy and movement than is normal or desirable, often associated with attention deficit hyperactivity disorder (ADHD).

Hyper-

A prefix meaning above or excessive, used to describe conditions of overactivity or elevated levels (e.g., hypertension).

Dys-

A prefix in medical terms indicative of abnormal, difficult, or painful conditions.

Diagnosis

The identification of the nature of an illness or other problem by examination of the symptoms.

Q1: What are some of the consequences of

Q10: Common examples of the Pension Model include

Q21: If you expect the market to increase

Q63: Ben is a 30% partner in a

Q107: The market value of common stock is

Q121: The capital asset pricing model (CAPM)links together

Q122: The expected value,standard deviation of returns,and coefficient

Q126: The cost of new common stock is

Q127: John transfers assets with a $200,000 FMV

Q155: Given the information in Table 8.2,what is