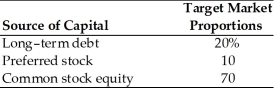

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The weighted average cost of capital up to the point when retained earnings are exhausted is ________. (See Table 9.1)

Definitions:

Health Insurance Coverage

A contract between an individual or employer and an insurance company to cover part or all of the healthcare expenses incurred by the insured.

Health Care Spending

The total amount of money spent on medical services, medications, and other health-related products and services.

Employer-Provided Benefit

Non-wage compensations provided to employees in addition to their normal salaries or wages, like health insurance, paid vacation, and retirement plans.

Q30: Suppose the CAPM is true.Asset X has

Q49: The general form of the annualized after-tax

Q60: All of the following are separately stated

Q66: The Current Model provides the future value

Q77: One of the characteristics of the Exempt

Q104: Distinguish between an annotated tax service and

Q108: For corporations,NSTCLs and NLTCLs are treated as

Q122: Charades Corporation is a publicly held company

Q122: In the syndication of a partnership,brokerage and

Q174: Dr.Dan is considering investing in a project