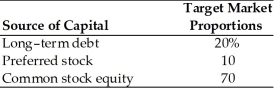

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year,$1,000 par value,7 percent bond for $960.A flotation cost of

Debt: The firm can sell a 12-year,$1,000 par value,7 percent bond for $960.A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value.The stock will pay a $10 annual dividend.The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share.The dividend expected to be paid at the end of the coming year is $1.74.Its dividend payments have been growing at a constant rate for the last four years.Four years ago,the dividend was $1.50.It is expected that to sell,a new common stock issue must be underpriced $1 per share in floatation costs.Additionally,the firm's marginal tax rate is 40 percent.

-If the target market proportion of long-term debt is reduced to 15 percent - increasing the proportion of common stock equity to 75 percent,what will be the revised weighted average cost of capital? (See Table 9.1)

Definitions:

Head Injury

Trauma to the head, which can range from a mild bump or bruise to a serious brain injury.

Short-Term Memory Loss

A condition where a person has difficulties retaining recent information, often a precursor to long-term memory issues.

Sensory System

The part of the nervous system responsible for processing sensory information received from the environment, including sight, sound, touch, taste, and smell.

Mental Status

A state of a person's cognitive and emotional functioning which includes their consciousness, attention, orientation, memory, and mood.

Q10: The after-tax cost of debt for a

Q15: The portfolio with a standard deviation of

Q31: Melanie is in the 39.6% tax bracket

Q41: If a partner contributes depreciable property to

Q45: Losses are disallowed on sales or exchanges

Q94: Investment A guarantees its holder $100 return.Investment

Q127: Tina's Medical Equipment Company paid a $2.25

Q146: The CAPM uses standard deviation to relate

Q178: An increase in the beta of a

Q193: In most cases,the longer the maturity of