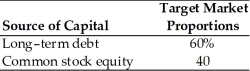

Table 9.2

A firm has determined its optimal structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 15-year,$1,000 par value,8 percent bond for $1,050.A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Debt: The firm can sell a 15-year,$1,000 par value,8 percent bond for $1,050.A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Common Stock: A firm's common stock is currently selling for $75 per share.The dividend expected to be paid at the end of the coming year is $5.Its dividend payments have been growing at a constant rate for the last five years.Five years ago,the dividend was $3.10.It is expected that to sell,a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs.Additionally,the firm has a marginal tax rate of 40 percent.

-The firm's cost of a new issue of common stock is ________.(See Table 9.2)

Definitions:

External Locus

Refers to an external locus of control, a belief that outcomes in one's life are largely influenced by external forces or fate rather than personal actions.

Type B Personality

A personality type characterized by a relaxed, patient, and easy-going nature, often contrasted with the more competitive and high-stress Type A personality.

Type A Personality

Type A personality is characterized by high levels of competitiveness, self-imposed stress, and a constant sense of urgency.

Perceive Major Life Changes

The recognition or awareness of significant transformations in one's personal life circumstances.

Q10: An S corporation distributes land to its

Q28: Akai has a portfolio of three assets.Find

Q69: Ordinary income may result if a partnership

Q71: Explain the legislative reenactment doctrine.

Q83: American Depositary Receipts (ADRs)are claims issued by

Q95: The transfer of property to a partnership

Q113: Suppose the CAPM is true.Asset X has

Q121: Ohio Corporation's taxable income for the current

Q126: In the Gordon model,the value of a

Q171: Investors should recognize that betas are calculated