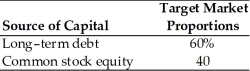

Table 9.2

A firm has determined its optimal structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 15-year,$1,000 par value,8 percent bond for $1,050.A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Debt: The firm can sell a 15-year,$1,000 par value,8 percent bond for $1,050.A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Common Stock: A firm's common stock is currently selling for $75 per share.The dividend expected to be paid at the end of the coming year is $5.Its dividend payments have been growing at a constant rate for the last five years.Five years ago,the dividend was $3.10.It is expected that to sell,a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs.Additionally,the firm has a marginal tax rate of 40 percent.

-The firm's cost of retained earnings is ________.(See Table 9.2)

Definitions:

Association

A statistical relationship between two or more variables, indicating how changes in one variable are connected with changes in another.

Sample Data

A subset of a population selected for measurement, observation, or questioning, to provide statistical information about the population.

Null Hypothesis

A statement that assumes no significant difference or effect exists in a set of observations, serving as the default assumption in hypothesis testing.

Chi-Square Test

A statistical method employed to ascertain whether a meaningful discrepancy exists between the anticipated frequencies and the actual frequencies across one or several categories.

Q9: Cumulative preferred stocks are preferred stocks for

Q30: The Gordon model assumes that the value

Q40: Suppose the expectations hypothesis is true.The current

Q57: Stephanie owns a 25% interest in a

Q61: Explain the difference between a closed-fact and

Q74: Which of the following is TRUE of

Q76: Asset A was purchased six months ago

Q120: The components of risk premium includes business

Q146: At year end,Tangshan China Company balance sheet

Q162: The _ describes the relationship between nondiversifiable