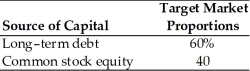

Table 9.2

A firm has determined its optimal structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 15-year,$1,000 par value,8 percent bond for $1,050.A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Debt: The firm can sell a 15-year,$1,000 par value,8 percent bond for $1,050.A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Common Stock: A firm's common stock is currently selling for $75 per share.The dividend expected to be paid at the end of the coming year is $5.Its dividend payments have been growing at a constant rate for the last five years.Five years ago,the dividend was $3.10.It is expected that to sell,a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs.Additionally,the firm has a marginal tax rate of 40 percent.

-The weighted average cost of capital up to the point when retained earnings are exhausted is ________.(See Table 9.2)

Definitions:

Forty-Year-Old

An individual or subject that has reached the age of forty, often used in demographics or studies to define a particular age group.

Significant Predictor

A significant predictor in statistics is a variable in a statistical model that has a strong relationship with the outcome variable.

Recent Mammogram

This term refers to the most current breast X-ray used to look for signs of breast cancer or other abnormalities.

Age

A measure of the time an individual has lived, typically expressed in years.

Q3: A liquidating corporation<br>A)recognizes gains and losses on

Q9: A(n)_ portfolio maximizes return for a given

Q28: Akai has a portfolio of three assets.Find

Q28: In an inefficient market,stock prices adjust quickly

Q65: As risk aversion increases _.<br>A)a firm's beta

Q70: Ron transfers assets with a $100,000 FMV

Q98: Returns (relative to risk)from internationally diversified portfolios

Q100: The firm's cost of a new issue

Q117: One requirement of a personal holding company

Q125: For purposes of the accumulated earnings tax,reasonable