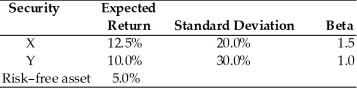

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3,what is the portfolio expected return and the portfolio beta if you invest 35 percent in X,45 percent in Y,and 20 percent in the risk-free asset?

Definitions:

Liabilities

Financial obligations or debts that a business or individual owes to others, which must be settled over time.

Total Return

The overall financial gain or loss on an investment over a specified time period, including both capital gains and any income received.

Long-Term Growth

The process of expanding or improving a business, investment, or economic endeavor over a considerable period, aiming for sustained and stable progress.

Functional Expenses

In non-profit accounting, these are the expenses directly related to the organization's programmatic, fundraising, and administrative activities.

Q6: Bond indentures include restrictive covenants.These provisions protect

Q22: Changes in risk aversion,and therefore shifts in

Q64: Payment of interest required only when earnings

Q71: A normal yield curve is upward-sloping and

Q83: Everything else being equal,the longer the period

Q98: Returns (relative to risk)from internationally diversified portfolios

Q118: A corporation is owned equally by 10

Q118: The less certain a cash flow,the _

Q131: Ted Corporation expects to generate free-cash flows

Q135: Tangshan China's stock is currently selling for