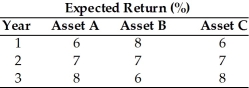

Table 8.1

-If you were to create a portfolio designed to reduce risk by investing equal proportions in each of two different assets, which portfolio would you recommend? (See Table 8.1)

Definitions:

Present Value

The current worth of a future sum of money or stream of cash flows given a specified rate of return.

Interest Rate

The percentage charged by a lender to a borrower for the use of assets, reflecting the cost of borrowing money.

Future Payment

A payment that is scheduled to be made at a specified date in the future.

Interest Rate

The cost of borrowing money, usually expressed as a percentage of the amount borrowed.

Q30: Sandy and Larry each have a 50%

Q59: Promo Pak has compiled the following financial

Q65: Richard has a 50% interest in a

Q75: One major expense associated with issuing new

Q91: Standard deviation is a measure of relative

Q91: A firm's flotation cost can be calculated

Q122: There is an inverse relationship between the

Q128: Risk that affects all firms is called

Q162: The _ describes the relationship between nondiversifiable

Q176: Floating-rate bonds are bonds that can be