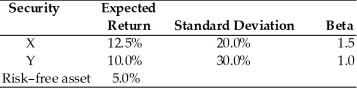

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3,what is the portfolio expected return and the portfolio beta if you invest 35 percent in X,45 percent in Y,and 20 percent in the risk-free asset?

Definitions:

Equality of Opportunity

The principle that all individuals should have the same chances to pursue economic or personal achievements, regardless of their background.

Equality of Outcome

The concept of ensuring that individuals or groups achieve the same results, often through redistributive policies.

Democratic Forms

Various structures or systems of government in which power is held directly or indirectly by the people, typically through elected representatives.

Government Weaknesses

Government weaknesses refer to the limitations, inefficiencies, and flaws within the structure and functioning of a government, which can hinder its effectiveness and service to the public.

Q17: As randomly selected securities are combined to

Q19: The beta coefficient is an index that

Q31: The _ feature permits the issuer to

Q38: Which of the following affects the slope

Q51: All costs of organizing a partnership can

Q54: Holding risk constant,the implementation of projects with

Q97: _ allow bondholders to purchase a certain

Q120: The components of risk premium includes business

Q121: In an efficient market,securities are typically in

Q132: Treasury stock is generally reclassified as class