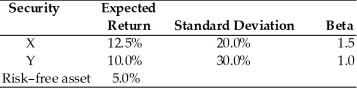

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3,what is the portfolio expected return if you invest 100 percent of your money in X,borrow an amount equal to half of your own investment at the risk-free rate and invest your borrowings in asset X?

Definitions:

General Partner

An owner of a partnership who has unlimited liability and is active in managing the firm, as opposed to a limited partner with limited liability.

Secondary Market

The market where investors buy and sell securities they already own, as opposed to the primary market where securities are first issued.

Foreign Exchange Market

A global marketplace for trading national currencies against one another.

Debt Market

A financial market where participants can issue and trade debt securities, often used by corporations and governments to finance their operations.

Q2: The present value of a perpetual income

Q3: When given a choice between making a

Q93: The number of authorized shares of common

Q98: Julie's X-Ray Company paid $2.00 per share

Q111: A firm has experienced a constant annual

Q149: A downward-sloping yield curve that indicates generally

Q174: The amount of money that would have

Q190: For normal probability distributions,95 percent of the

Q203: The possibility that the issuer of a

Q206: IBM stock will experience greater trading activity