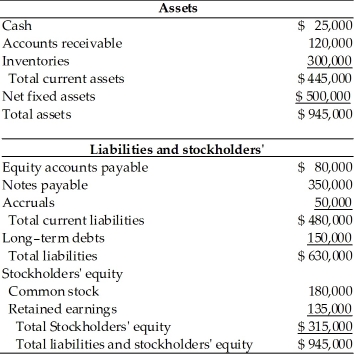

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-The pro forma net fixed assets amount is ________. (See Table 4.5)

Definitions:

Intrinsic Value

The actual, fundamental value of an asset based on an understanding of its true characteristics, including all aspects of the business, in terms of both tangible and intangible factors.

Option

A financial derivative that gives the buyer the right, but not the obligation, to buy or sell an asset at a specified price on or before a certain date.

Q3: The largest single source of funds for

Q19: The _ is useful in evaluating credit

Q28: A large portion of the commercial paper

Q62: The liquidity of a business firm is

Q94: Calculate the present value of an annuity

Q99: Under MACRS,an asset which originally cost $100,000

Q113: Lines of credit are non-guaranteed loans that

Q137: The Tax Cuts and Jobs Act allows

Q148: Calculate the future value of $4,600 received

Q159: The value of a bond that pays