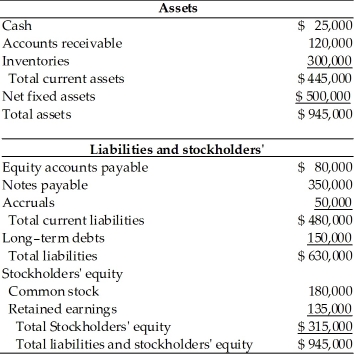

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-The pro forma accumulated retained earnings amount is ________. (See Table 4.5)

Definitions:

User-friendly

Describes a product or system that is easy to use or navigate, enhancing the overall user experience.

Software

Programs and operating information used by a computer to perform specific tasks.

Job

A position of employment where an individual performs assigned duties, usually in exchange for compensation.

Annual Performance Reviews

Formal evaluations conducted yearly to assess an employee's work performance, discuss achievements, and set future goals.

Q24: In giving up a cash discount,the amount

Q25: The firm has a negative net cash

Q38: When an investment bank buys new securities

Q54: If a firm anticipates stretching accounts payable,its

Q61: A revolving credit agreement is a form

Q69: Which of the following is TRUE of

Q87: A _ is a short-term,unsecured promissory note

Q93: Factoring accounts receivable is relatively an inexpensive

Q96: Which of the following is a limitation

Q120: Zheng Sen wishes to accumulate $1 million