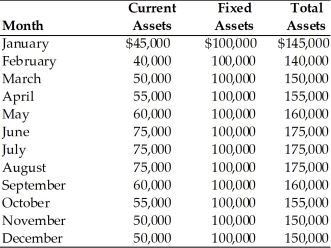

Table 14.1

Irish Air Services has determined several factors relative to its asset and financing mix.

(a) The firm earns 10 percent annually on its current assets.

(b) The firm earns 20 percent annually on its fixed assets.

(c) The firm pays 13 percent annually on current liabilities.

(d) The firm pays 17 percent annually on long-term funds.

(e) The firm's monthly current,fixed,and total asset requirements for the previous year are summarized in the table below:

-The firm's monthly permanent funds requirement is ________.(See Table 14.1)

Definitions:

Liabilities

Financial obligations or debts owed by a business or individual to others, which must be paid in the future.

Journalize

The act of recording business transactions in the chronological order of occurrence within the accounting journals.

Transactions

Economic activities or events that affect the financial position of a company, recorded in its accounting records.

Acquisition Costs

The total cost incurred to acquire an asset or service, including the purchase price and any additional costs necessary to bring the asset into working condition.

Q7: A firm conducting an IPO of common

Q45: Money markets involve the trading of securities

Q61: In finding the operating breakeven point,it is

Q64: The Eurocurrency market is a market where

Q84: Securitization made it harder for banks to

Q92: The base level of EBIT must be

Q95: A firm which uses the aggressive financing

Q142: With a floating-rate note,the interest rate on

Q167: One function of breakeven analysis is to

Q186: A decrease in collection efforts will result